The area housing market experienced a boost in the number of single-family detached home listings from February to March but is still down significantly from the same month a year ago in most communities as the total number of sales also lags.

Boulder, Fort Collins, Longmont, Greeley/Evans and Loveland/Berthoud all had month-to-month increases in active listings, according to figures released Monday by the IRES Multiple Listing Service. But Greeley/Evans continued to be the only local area of the five where the number of year-to-date sales has outpaced 2013.

The Greeley/Evans area has had 316 single-family detached homes sell this year, up from 287 at the same point a year ago. Median sale price of those homes in March was $184,000, up significantly from $164,500 a year ago.

With the low inventory, Boulder's median monthly price for single-family detached homes continued to soar, hitting $685,000 in March, up from $633,750 for the same month a year ago.

Fort Collins had 228 single-family detached home sales in March, with a median sale price of $255,750, up $750 over a year ago. In Loveland, 126 such homes sold, with a median price of $257,654 that was up nearly 10 percent from a year ago. Longmont's median price for its 74 sales was $270,250, up 3.7 percent from a year ago.

While single-family detached-home prices showed strong growth throughout, attached single-family sale prices lagged in March, dropping in all but one of the five local areas from February. Only Loveland had an increase in median price in the category, from $160,500 to $174,900 for the 31 listings sold.

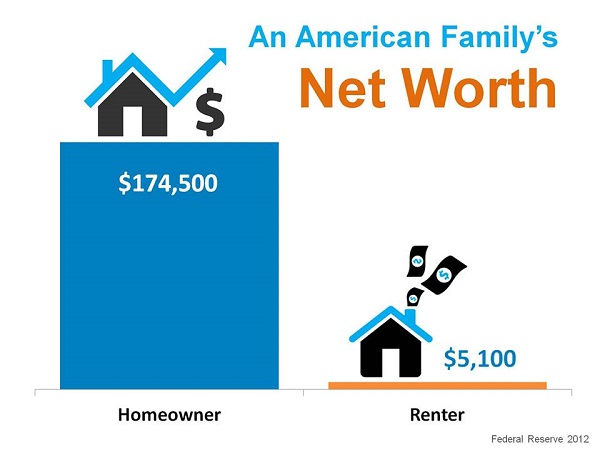

Home Ownership's Impact on Net Worth

Over the last six years, homeownership has lost some of its allure as a financial investment. As homeowners suffered through the housing bust, more and more began to question whether owning a home was truly a good way to build wealth. A study by the Federal Reserve formally answered this question.

Some of the findings revealed in their report:

The average American family has a net worth of $77,300

Of that net worth, 61.4% ($47,500) of it is in home equity

A homeowner’s net worth is over thirty times greater than that of a renter

The average homeowner has a net worth of $174,500 while the average net worth of a renter is $5,100

What Generations are Buying & Selling These Days?

A new study from the National Association of Realtors (NAR) has found that the Millenial Generation now account for the greatest market share of recent home purchases. The NAR Home Buyer and Seller Generational Trends Study for 2014 revealed Millenials comprised 31% of recent purchases, leading all other age groups. Additionally, Generation Y made up 76% of first-time home buyers. This demographic shift should be considered when selling your home, from staging to marketing. Read the complete report here.